Back away. Back. Away. Now.

I’ve got a sharpened #2 Ticonderoga pointed at my jugular, and I’m not afraid to use it.

The floor is littered with broken pencils, crumpled 8863s and tufts of naturally blond hair, pulled out by the roots. The air reeks of stale coffee and desperation.

I’ll never get my taxes done.

First I have to do federal for daughter #2 as a dependent, then again with her on her own. After I figure which is best, I need to do federal for me and the hubster. Then do state of Illinois for me and state of California for daughter #2.

Then pay everyone money. Lots and lots of money.

I’m an intelligent woman. For cripes sake, I took both tax and cost accounting in college. But I can’t do it. I CAN’T DO IT!

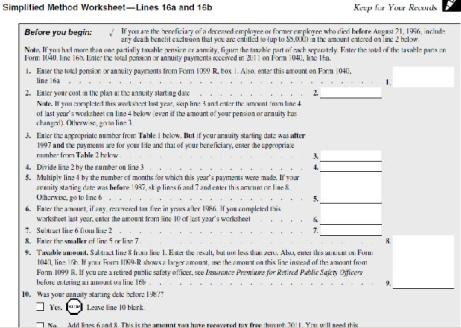

These are the actual instructions for a worksheet from the 1040 instructions. No, don’t look away, you coward. In order to fight evil, you must first recognize it.

This is the “Simplified Method”, thank goodness! All you have to do is:

1) Enter the total annuity payment from the Form 1099-R

2) Enter the cost of the starting plan, except if you completed this worksheet last year. Then skip line 3 and enter the amount from line 4 of last year’s worksheet on line 4

3) Enter the appropriate number from Table 1 below, BUT if the annuity starting date is after 1997 then

4) left hand red and

5) right foot blue

The IRS is playing Twister with my brain.

I can’t even figure out when I need to send these in. Aren’t taxes always due on 4/15? Unless 4/15 falls on a weekend, then it’s the next business day. Unless the next business day is a holiday in the District of Columbia. No fooling. Washington D. C., one city – not even a state – is having a holiday, so the due date has been changed for the entire country.

Well guess what? I can’t turn my taxes in on Monday, because it’s an important holiday here in Peg-o-Legville. It’s the annual Goober Festival. We spend the entire month of April celebrating this character’s lasting contribution to American television. Some also celebrate peanuts, and that’s ok, too. The point is it’s only fair that NOBODY has to do his or her taxes until 5/1 when our holiday is over.

Why can’t there be one tax? They could shorten the whole, foul business down to 2 lines on the return:

-Did you make any money last year?

-Send it in.

Shhh. What was that sound? Did you hear that? They’ve got the place surrounded. The IRS is everywhere, and now they’re coming for me, but I’m not going quietly. I’m taking their foul minions down with me. They will all be bloody with pointy pencil pokes and paper cuts before this is through.

It’s too late for me, but save yourselves! File the short form.

Heh, funny, but then not funny, you know. I hate them and I hate their forms. And they give me migraines.

LikeLike

The good thing is that the cost of aspirin to fight those migraines is tax deductible! If it exceeds 10% of AGI.

LikeLiked by 2 people

I knew your accounting classes were good for something!

LikeLike

“The IRS is playing Twister with my brain.” You got it. Give up and send all the money…at their leisure when it amuses them.

Pointy pencil pokes!

LikeLike

I should just give up, but I’m a fighter. They’ll never get my money – never!!!!

LikeLiked by 1 person

Yeah, just change it to: Got money? Gimme!

I tried to read part of the “simplified worksheet” but I blacked out after the first sentence. I can’t handle taxes,which is why I let Turbo Tax do it for me.

Here’s hoping you get through this weekend with at least a few tufts of blonde hair left on your head. My advice is a glass of wine will make it allllll go away…

LikeLiked by 1 person

Hey, cutie pie! Nice to see your smiling avatar about.

One glass of wine? You seriously underestimate the size of my tax woes.

LikeLike

Wow, Ms Funny Lady, you’ll hit some nerves with this post. I quit doing my taxes in ’14 when they were so convoluted that my tax man raised his fee to $1,700 per year. Ouch. Yes, $1,700 to tell the IRS that I owe them zero.

That’s just not right. So, I said “no thank you.”

What will they do, send me to jail? That’s ok, I need a crown fixed…glad I’m not the only one in this life boat with holes.

Thanks for my Friday laugh!

LikeLike

You raise a good point. When in jail you get full dental, which is something most of us taxpayers (including me) don’t get on the outside. It’s all good!

LikeLike

Worse, they can make you do your taxes every year all by yourself.

LikeLike

It’s ridiculous, isn’t it? We have someone do our taxes. My understanding of the stuff could fill a thimble. Kudos to you for taking this on for your family. They owe you a trip to Hawaii. Tax-exempted, of course.

LikeLiked by 2 people

I’m ashamed to admit that this year, for the first time, I’m having our accountant do our taxes. I feel like such a failure.

LikeLiked by 1 person

No need to feel like a failure. There’s only so long you can be a tax superhero. I think the limit is five years. With a cape, maybe six years.

LikeLike

Super Taxman’s cape is gray pinstripe, right?

LikeLiked by 1 person

Yep.

LikeLike

I took a clas on tax law when I was going to law school, and I use TurboTax, and it’s still a hellacious process. Oy.

LikeLike

I know, right? Wouldn’t you think a college-level tax class (or two or three) would make us qualified to tackle this chore?

LikeLike

I did learn a few things. For instance, the Congressman responsible for the Tax Reform Act of 1969, Wilbur Mills, was involved in a scandal when he and an Argentinian stripper named Fanny Foxe were stopped by police. When they approached the car, apparently Ms. Foxe tried to escape by leaping into the Tidal Basin. She later became known as the Tidal Basin Bombshell. Now you know! And knowing is half the battle!

LikeLike

Just thinking about it makes my head hurt. I still do my own taxes, but it gets harder each year.

LikeLike

I threw in the towel this year for the very first time. Life fail.

LikeLiked by 1 person

They should mandate a national week of holiday for taxes each year…starting on the 14th (national ‘Last Minute’ day), the 15th (national ‘Empty your Savings’ day) and extend it out until the 22nd (national ‘5 days of Recovery from the IRS Raping’ week).

As this would be a national holiday, everyone has the entire week off (except police, fire fighters, hospital workers, grocery store employees, and bartenders).

It could be a bigger party than Mardi Gras. But, instead of flashing your boobs for a string of beads, flash your completed return for free (insert beverage of choice).

LikeLiked by 1 person

I like the way you think! But in order to fund this party, they’re going to have to raise your taxes. Just sayin’.

LikeLike

Ok, I’m not going to political rant here, but seriously, this is why we need Ted Cruz. His tax plan? It’s LITERALLY the size of a post card. You get child credit & standard deductions, and must make a minimum to pay (I think it was $30K), and then it’s 10%. (16% for corporations). That’s it. If it’s good enough for the Lord, it’s good enough for Uncle Sam. AND it will eliminate the need for the IRS. (Hurrah! Buh-bye…don’t the door hit you in the butt on your way OUT!!)

LikeLike

That would be sooooooo lovely. But it will never happen, because congress likes to reward and punish special interests and they use the tax code to do it.

LikeLiked by 1 person

Where taxes really get convoluted is retirement investments. They’ve changed the laws around that crap so many times because of all of the lawmaker’s own investments. “If you have this type of IRA, then you hop up and down on one foot and pay through the nose. But if you bought this other investment when there was a blue moon, you owe nothing.” Having to deal with taxes on my inherited IRA’s has been insane. If you don’t pay estimated taxes throughout the year, because you want to just pay what you owe on April 15, they ding you. Apparently, because of a few bad apples, the IRS doesn’t trust anyone to be able to save their money and pay what’s due when it’s due. Taxes suck!

LikeLike

IRAs and capital gains are what drove me to hire an accountant this year. It makes no sense at all.

LikeLiked by 1 person

I have an accountant, for sure.

LikeLike

I think I’ve finally figured this out. Because of taxes, they say the average American works the first five months of the year for the government before they’re actually making their own money, right? So why not have the employer send your pay directly to the IRS for the first 5 months and then give it to you after that? No 1040 paperwork hassles, no wondering which day is the actual Tax Day deadline, no paying accountants just to tell you that you owe the government!

The only drawback is that if Bernie gets in you’ll be working for the government for the first 10 months, but that should be an easy switch-over for your employer’s payroll section to make.

LikeLiked by 1 person

That’s genius! And because Bernie will mandate that there will be a free chicken in every pot (as well as a pot, a stove to put it on and a house to keep them all) we won’t even miss having no income for 5-10 months. Hurrah!

LikeLike

It’s not you, Peg. It’s them. My husband practiced tax law for a number of years. He can’t figure out how to do our taxes.

And think of the youngins. My son get 1099s from three different companies because nobody actually hires people they just hire contractors who are on their own …

The only good news is that I don’t have to do anybody’s taxes.

LikeLike

Now I don’t feel so bad, Elyse. And you’re right about the younguns. I did my youngest’s return in exchange for claiming her and taking her student tax credit, but the oldest wound up paying someone to do hers. I doubt she has any idea what any of it means.

LikeLiked by 1 person

When they say it’s not you…it’s you. That’s been my experience.

LikeLiked by 1 person

We’re all screwed when it comes down to it.

LikeLike

Agree. What can be done? As Bukowski would say…scramble two.

LikeLiked by 1 person

Sitting in a Jackson-Hewitt office (I’m a tax preparer) giggling at your post. I needed this laugh cause I’m sick of my old sensitive co-workers. An hour ago, one got offended cause i asked the other to void a tax return for me on the computer when she walked in. She took it as a slight as i overheard her whispering “he didn’t tell me to do it” as if i did it on purpose. You see, the offended one is a tax preparer and the other one is a manager. Me and the former was alone in the office for 30 minutes before the manager. I actually forgot the return until i saw the manager cause we spoke on the phone this morning exactly about voiding the return cause the customer wasn’t ready to pay the fees.

So happy its only 3 days left. I rip those countdown numbers off the wall proudly every night i leave.

LikeLike

Oh my! I’d be on your guard if you see that co-worker coming toward you with an extra-sharp pencil – sounds like she might have it in for you now.

LikeLiked by 1 person

Sorry for ranting. Needed an outlet for my frustration and I saw your post.

LikeLike

No prob. I don’t like to rant alone here.

LikeLiked by 1 person

I still do ours but I’m down to the wire. Monday is the due date and I’ve barely looked at them. Yikes is me, as I prepare to road trip to BC for a day. Then it’s back home Sat afternoon. Pat’s lined up some helpers to continue working on the basement and all the “stuff” to sell or get rid of in next week’s sale, Shepherd Maple Syrup Festival. Our first ever. This frantic pace is exhausting.

And don’t feel bad about using an accountant. I’m thinking about it…

LikeLike

Hey, we’re on here at the same time! You’re going over tonight? Bless you. I thought the garage sale was tomorrow and that was why you were heading back early.

Could you read my text about M&D’s party, etc and reply? Thanks, ducks!

LikeLike

I texted a reply that the date should be OK. Off I go! Have a great weekend!

LikeLike

IL state is a greedy bastard, isn’t it? Federal owes me a refund, but those greedy IL bastards make me pay them! One more time; Greedy bastards.

LikeLike

The incompetent, corrupt state of IL government is the perfect argument against socialism.

LikeLike

can’t you just do that thing where you throw all your money up in the air and the IRS takes what they want?? Or is that God?

LikeLike

I heard in Sweden, their equivalent of IRS sends taxpayers a completed tax form and basically says, sign here and mail back to us if this looks right to you, or have fun doing the taxes all by yourself. They also give you the money that we have to file for in the tax forms as tax credits and deductions.

But that’s socialism, we can’t have that.

LikeLike

Wait — no one ever explained this to me — why is socialism bad?

LikeLike

Just mailed my taxes and lots of money this afternoon! Used to do our taxes but it just got too complicated.Actually got them to the CPA before all our troubles in BC. Thank goodness.Enjoy the weekend with Liz.

LikeLike

Mine won’t be ready for review until Monday. Talk about the last minute -yikes! Having a great weekend, and hoping your birthday is fan!

LikeLike

I can tell in germany it’s just the same…maybe worldwide?

LikeLike

Definitely. At least in the US and Germany they don’t come with armed thugs to collect your money, right?

LikeLiked by 1 person

I threw in the towel and stopped filing years ago. You think that’s a problem?

LikeLike

That’s how they finally got Al Capone.

LikeLike

Good point. The guvment might let thievery and murder slide, but not paying your taxes means hell to pay!

LikeLike

Did you really have to pay? Because, I swear to Jeebus, I don’t know anyone who actually has to write a check at the end of FY. Everyone gets a refund. Everyone!

I pay a guy to do mine. I waved the white flag decades ago. I sleep better for it.

LikeLike

Nah, I’m getting a refund. But that’s only because I have way too much withheld and let the guvment earn interest on MY money to avoid paying at year end.

Just signed the forms and faxed them back to my accountant with whole hours to spare!

LikeLike

You are admittedly giving them an interest free loan. You should find that sweet spot where you neither pay nor get a refund.

LikeLike

I love this! You nailed it spot on, with hilarity and grace! Have fun until 5/1!

LikeLike

Thanks. Happy Goober Days to you and yours!

LikeLiked by 1 person

There must be a tax app or a tax crap app or a tax my ass app. They’re called smart phones for a reason, right?

LikeLike

Over here we don’t have to do a tax return unless we are self-employed or have our own business, so for the general employed we don’t have to worry about such things. I’m not sorry. I’m sorry for you guys though *snigger.

LikeLike

I can’t wait to make money again so I can pay taxes. Wait. That’s not why. Danny handles the taxes, thank God. I pray you are over the hump, dear Peggles.

LikeLike