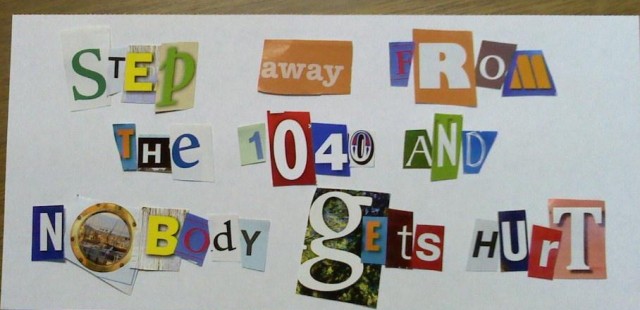

Back away. Back. Away. Now.

I’ve got a sharpened #2 Ticonderoga pointed at my jugular, and I’m not afraid to use it.

The floor is littered with broken pencils, crumpled 8863s and great tufts of naturally blond hair, pulled out by the roots. The air reeks of stale coffee and desperation.

I’ll never get my taxes done.

First I have to do federal for daughter #1, daughter #2 and me (with hubby). I’ve got to figure it first with daughter #1 as a dependent, then again with her on her own. Do state of Illinois for daughter #2, then for me. Do state of Iowa for daughter #1. Looks like I owe this year, so now I’ve got estimated taxes. Calculate 1st qrtr 2012 federal then the same for state.

Then pay everyone money. Lots and lots of money.

I’m an intelligent woman. I took both tax and cost accounting in college, for God’s sake! But I can’t do it. I CAN’T DO IT!

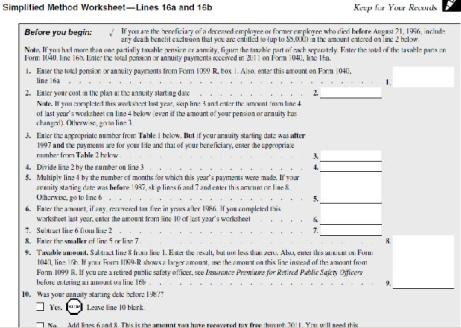

These are the actual instructions for a worksheet from the 1040 tax book. No, don’t look away, you coward. In order to fight evil, you must first recognize it.

This is the “Simplified Method”, thank goodness! All you have to do is:

1) Enter the total annuity payment from the Form 1099-R

2) Enter the cost of the starting plan, except if you completed this worksheet last year. Then skip line 3 and enter the amount from line 4 of last year’s worksheet on line 4

3) Enter the appropriate number from Table 1 below, BUT if the annuity starting date is after 1997 then

4) left hand red and

5) right foot blue

The IRS is playing Twister with my brain.

I can’t even figure out when I need to send these in. Aren’t taxes always due on 4/15? Unless 4/15 falls on a weekend, then it’s the next business day. Unless the next business day is a holiday in the District of Columbia. No fooling. Washington D. C., one city – not even a state – is having a holiday, so the due date has been changed for the entire country.

Well guess what? I can’t turn my taxes in on Tuesday, because it’s an important holiday here in Peg-o-Legville. It’s the annual Goober Festival. We spend the entire month of April celebrating this character’s lasting contribution to American television. Some also celebrate peanuts, and that’s ok, too. The point is it’s only fair that NOBODY has to do his or her taxes until 5/1 when our holiday is over.

Why can’t there be one tax? They could shorten the whole, foul business down to 2 lines on the return:

-Did you make any money last year?

-Send it in.

Some think a flat tax would be bad for the economy. They worry about dislocated workers. All the bartenders and junk-food industry workers would go on as before, though; we need that stuff whether we’re happy or sad. Sure, the straightjacket and wig industries will shrink, but we’ll need lots more balloon artists, mimes and paddleboat operators. If they didn’t have to do taxes, everyone would be out frolicking in the park, enjoying the spring.

I know I would.

Shhh. I heard something. They think they can sneak up on me, but I hear them. The IRS is everywhere, and now they’re coming for me. They’ve got the place surrounded. It’s too late for me, but save yourselves!

I’m not going quietly. Oh no! There are going to be pointy pencil pokes and paper cuts all up in this joint!

I feel your pain. Actually I don’t, because my own is drilling holes into my eyeballs and chomping away at my ankles. I just wrote my first quarterly payment to the IRS (Note: You are an “Independent Contractor.” This means you get no employee benefits AND you get no self-employed deductions, like home office space, etc. You exist in a Netherworld of your own creation.)

LikeLike

I feel you feeling my pain as I feel your pain. Just put the address on the federal, got both girls’ returns done. Now all I have to do is the state and one more estimated. That’s really adding insult to injury to have to pay estimated (first time for me in a LONG time) on top of the 2011 payment. Especially since the great state of Illinois almost doubled the tax rate last year. Grumble, grumble, grumble.

LikeLike

Easy, Peg. Put the pencil down, breathe, hire a CPA, it will be cheaper than therapy.

LikeLike

I seriously thought about it this year, but I waited until the last minute so now there isn’t time for a CPA. The end is in sight, though -both for the returns and my money. Instead of our usual “what should we spend our refund on?” conversation, it’s “what would it be easier to do without for the next few months – gas or food?”

LikeLike

Hey, we’re having the same conversation at our house.

LikeLike

My heart is racing and my palms are sweating. Literally. I was fine when I was in my 20s – the EZ form was a breeze. Once I married, I passed the stuff to Rob. Oh my gosh, just typing this is making me all anxious. I know folks didn’t care for Herman Cain, but I truly like his 9-9-9 plan, and I am a huge fan of the Fair Tax. Tax reform is needed … like yesterday!!!

LikeLike

I like Herman Cain just fine, and I think he had a great idea – a bit simple, but it could be tweaked. Just about ANYthing has got to better than this hellish system. Have a glass of wine and breathe deeply, Lenore. We’ll get through this.

LikeLike

“No, don’t look away, you coward” I laughed so hard.. I don’t want to look at tax forms! Thank goodness for Turbo Tax and my hubby. Also, every tax year my poor co worker swears she will do her taxes early, guess who still hasn’t done them, poor thing. I hope you still have some hair left to work with after the taxes are all said and done. Good luck!

LikeLike

I would normally use my refund to buy a new wig, but no refund this year. Thank your lucky stars you have a hubby to take care of this! When I go crazy my hubby just asks, “Explain again about the “innocent spouse” rule?”

LikeLike

Do you know how hard it was just to read a post with ‘1040’ in the title? I started having heart palpatations with the first line.

Oh, Peg. Dear sweet Peg. You have had quite the week! First you took over the blogging world, and now this? Your brain must be ready to pop at any second. (It already did, didn’t it? It’s okay. There, there, have another glass of wine)

Hey, I know what will help, my migraine-inducing video with the mind-numbing graphics all up in your face. Just watch it a few dozen times and this tax crap will all melt away, I swear.

LikeLike

That video DID help. A lot. Thank you for sending such brilliant diversion to a soul in tax-torment, Darltaxia 1040.

LikeLike

Simplify the tax code? That suggestion is proof-positive that you’ve lost your marbles. Maybe you should file for an extension Until After Goober Day, get rested up and tackle these tax forms when you’re back from Loopy Land. And get your daughters to join in on the fun. Why are you depriving them of the excitement of seeing how much they will have to pay? 😉

LikeLike

I know – you’re right. I thought I’d get daughter #1 through the torment of switching states, but I am resolved to get started earlier next year, and make her sit down and do it with me. Both of them! In fact, why am I doing this stuff – why can’t the hubby do it? Yeah!

Going to get some peanuts for a little break.

LikeLike

Ha! Oh, that killed me when you said, “Don’t look away you coward” because I really wanted to! And you’re right, they really could narrow it down to just 2 fields!

May the force be with you. And not behind you. Stalking you. Waiting to take your money.

LikeLike

I would lobby for the 2nd line to read “send half of it in”, but that’s just because I’m a greedy 1%er.

The force is feeble in me, Jules. All my money, time and talent are slowing ebbing away. Slowly, slowly, I sink into oblivion while your life force grows ever stronger and you TAKE OVER THE WORLD!!!!!

LikeLike

OMG. I’m like a dementor (from Harry Potter). Awesome.

LikeLike

I’m not accusing YOU of sucking my soul out, it’s just coincidence that you’re rising up to awesome, mind-blowing power while my life swirls down like a flush of a not-quite-clean toilet. Not your fault.

LikeLike

I don’t buy it. I’ve seen the pics of you on your (ever hilarious) blog lately. Looking svelt and gorgeous.

You even inspired Darla to make that kick-butt video!!

LikeLike

I hate to disappoint, but there’s no way I’m going to do anything but ‘look away’, Peg!

Seriously…

my computer monitor would start slowly rotating a full 360 degrees and speaking in tounges…

and that’s just a bit too much to take. On a Monday, anyway.

🙂

LikeLike

You could do some beautiful artwork with a 1040, SIG. Hmmmm.

LikeLike

Believe it or not I used part of one, once.

True story!

Just don’t tell ‘the man’!

🙂

LikeLike

Yeah, Peg. Why are you doing the girls’ taxes? Everyone has to learn how to do this fun stuff!

I finished my taxes on Saturday, then spent most of Sunday preparing lesson and unit plans, preconference and another form I had to write for my “evidence binder” (teachers have to do this now as well). The Supt. was in our house observing the teachers today. STRESSFUL!!! But I made it through, the class went well and I can breathe again. Whew….

Pat never messes with the taxes, probably because he knows I’ll get it done and there’s no way in hell I’m sending things in late. They’re ready to go (yes, the old paper form) just have to take them to the PO and watch them date stamp the envelope, then send them on their merry way.

After I figured I owed Fed, I wasn’t going to spend more money filing on-line. It’s been hell. Maybe now I can slow down??? No, have to prep for MKs party Sunday, if anyone is coming. Get ‘er done and have a few glasses of wine to chase the $$ misery away! 🙂

LikeLike

You’re right – I know you are. I just have to get them at home long enough to explain it. Next year, for sure!

I’m glad you’re done with your assessment and all went well. I knew you’d ace it!

I so wish I could come to the party, but we already had commitments for both Saturday and Sunday. Why, oh why, must I be so dang popular?

LikeLike

Would you mind balancing my checkbook? 🙂

LikeLike

Sure – send it over (accompanied by fatalistic shrug and “what the hell” expression).

LikeLike

Peg, I think you need some peanut butter cups. 🙂

LikeLike

Nooooo! I ate so many I gained 5 pounds last week. Must…stick…to…diet!

LikeLike

I think I can muster up a few dust bunnies to send. You could glue them into the spaces where hair used to be until it grows back or you can afford a wig.

LikeLike

Thanks for the offer, but I’ve got PLENTY of dust bunnies hanging around here. Hmmm. That might work, though. Mixed with all the hair my cat sheds and I could be rocking a whole, new look.

LikeLike

Let’s meet for coffee and laugh over our “extensions” which simply prolong the misery.

LikeLike

I didn’t do an extension, because if I have to pay, I’ll just get socked with penalties anyway. Hope your misery is done soon!

LikeLike

I literally start having anxiety attacks when the latest Turbo Tax is downloading! On top of everything else to confuse me, I am mathematically challenged. The pain it causes is just inhuman. BTW, I thought Maine and Massachusetts caused the change in date. Monday was Patriot’s Day (the guys with the muskets and funny hats, not the football team) – state holidays for ME and MA.

LikeLike

Breathe deeply – in, out, in, out. We can get through this.

You may be right about those states, but the reason given in the Form 1040 instructions is the Emancipation Day holiday in DC. Just too weird to me.

LikeLike

I have to ask: why do you do your daughters’ taxes? Nobody should have to do that more than once, for themselves. I do my own, and they’re very easy because, well, I own nothing and have no complicating/mitigating factors. (I’ll buy a house and muck it up soon enough.) But it’s still a pain, because I swear there’s something you’re supposed to enter on one line that you can’t come up with until you do the calculation for the next line. I can never remember what it is until I get there and I yell, “THAT’S IT! THAT’S THE ONE!” I once hired a CPA because I’d switched jobs and worked in a different state from where I lived. Wasted $150 on something I could have done myself. Godspeed, Peg-O. Godspeed.

LikeLike

I’m doing them because I’m taking them both as dependents on my return – the oldest for the last time since she graduated from college last year. I had to figure which way was least expensive. But I already put her on notice – never again!

I wonder if it’s wasted money. I use a CPA for my business, but I’ve always done my own personal because I was a finance major, and it’s a bit of a point of honor. I may be missing deductions by not going to the pro. I’ll need to think about this sooner next year.

I think the people who design IRS forms are the same ones who do those really, really confusing maze puzzles. The fiends.

LikeLike

Two words: Tax evasion. They’ll never come after small frys like us. You go first and let me know how it works out.

LikeLike

That’s what I admire about you, Al. Your willingness to (let me) blaze a new trail!

LikeLike

Ugh… don’t remind me! Our taxes in Canada are due on the 30th, and I just confirmed what I suspected all along– we owe everything we have, and then a little bit more. That would be one benefit to being a student forever– tax refunds GUARANTEED. None of this “self employed, fork it ALL OVER” crap. 😦

LikeLike

I live in the 1950s and my (banking consultant) husband takes care of all our financial matters including taxes. I hear there’s this thing called money and that we need it or something. And that the government needs it too.

“Ward, will you please tell me what a 1040 is?”

LikeLike

Don’t worry your pretty little string of pearls about any of this nonsense. Another martini, Angie?

LikeLike

File an extension. It’s easy to do & you almost never get rejected. That gives you 6 more months! Then hire a good CPA. Take it from a Bookkeeper who works for a CPA firm, until we get that flat tax I keep praying for, never do your own taxes.

LikeLike

I think you’re right – next year for sure!

LikeLike

I’m sure glad that we didn’t finish and mail in our taxes as late as the reply I’m making here on your post! But I just wanted to say that even the IRS should understand that Goober is a genuine American National Treasure, and celebrating his profound and positive influence on American culture should always be a valid excuse for a filing extension. I’m writing to my Congressman and Senators right now on your behalf!

LikeLike

Thanks for your support. Victory is within our grasp!

LikeLike